Tax Haven

-

Max

- Level 2 user

- Posts: 24

- Joined: Mon Nov 20, 2023 10:47 pm

Tax Haven

I was wondering; how are taxes collected from corporations? it makes sense that it works off the HQ location, but an HQ isn't necessarily required to make a corporation with firms in multiple cities. Is there a way to tell what city your Corp is paying taxes to? and is there a way to cheese this by making an empty city with 0 tax where you set up your HQ?

- Stylesjl

- Community Contributor

- Posts: 270

- Joined: Sun Oct 29, 2023 4:01 am

- Location: Sydney, Australia

- Has thanked: 2 times

- Been thanked: 12 times

Re: Tax Haven

I am not entirely sure how it normally works. But I think it is based on the firms individual profit/loss. For example if you setup Banking/Insurance the taxes go to the city it is headquartered in, which can lead to a situation where if these firms become very profitable you could end up having a city with HUGE amounts of tax revenue coming in (and hence that city can lower taxes/lavishly spend). I figured this out because that's what happened, the cities I had those firms headquartered in pulled in huge amounts of taxes. But this is not the company headquarters - this is the Insurance/Banking headquarters.

But for other businesses like factories I think if the factory makes a profit the factory profit goes to the city. This might potentially lead to a situation where you could engage in Base erosion and profit shifting, such as making losses in retail within the high tax cities but having the factories in a low tax city making all the profit. But I haven't tried it as I am not sure if that is how it works or how effective it might be.

I also don't know how this effects other ways of making profit such as stocks/bonds/dividends which are not tied to a specific firm. I tried once having my parent company (instead of Insurance) buy up a huge amount of the global stock market - but strangely the city where my headquarters was located didn't experience any major tax boom (but my insurance city was being deprived of revenue).

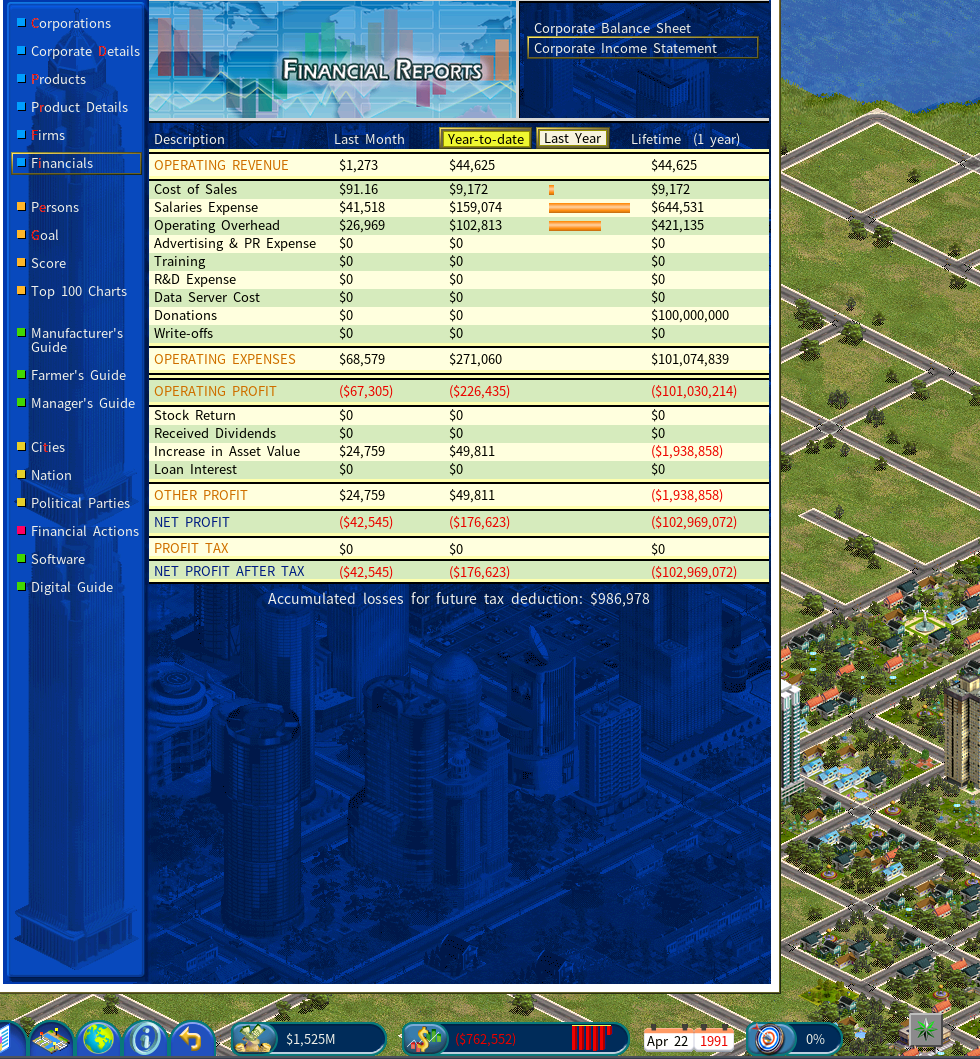

In fact it looks like the dividends are not taxed at all:

Would be good to see if anyone has any additional information on this.

But for other businesses like factories I think if the factory makes a profit the factory profit goes to the city. This might potentially lead to a situation where you could engage in Base erosion and profit shifting, such as making losses in retail within the high tax cities but having the factories in a low tax city making all the profit. But I haven't tried it as I am not sure if that is how it works or how effective it might be.

I also don't know how this effects other ways of making profit such as stocks/bonds/dividends which are not tied to a specific firm. I tried once having my parent company (instead of Insurance) buy up a huge amount of the global stock market - but strangely the city where my headquarters was located didn't experience any major tax boom (but my insurance city was being deprived of revenue).

In fact it looks like the dividends are not taxed at all:

Would be good to see if anyone has any additional information on this.

- cantdownloadit

- Community Contributor

- Posts: 653

- Joined: Sat Aug 30, 2014 12:14 pm

- Has thanked: 5 times

- Been thanked: 11 times

Re: Tax Haven

i like to build my own city, put all my big earners there, then set low tax rate so everyone loves me

- Attachments

-

- Image1.jpg (91.91 KiB) Viewed 2520 times

-

Max

- Level 2 user

- Posts: 24

- Joined: Mon Nov 20, 2023 10:47 pm

Re: Tax Haven

Stylesjl wrote: ↑Thu Nov 23, 2023 6:09 am I am not entirely sure how it normally works. But I think it is based on the firms individual profit/loss. For example if you setup Banking/Insurance the taxes go to the city it is headquartered in, which can lead to a situation where if these firms become very profitable you could end up having a city with HUGE amounts of tax revenue coming in (and hence that city can lower taxes/lavishly spend). I figured this out because that's what happened, the cities I had those firms headquartered in pulled in huge amounts of taxes. But this is not the company headquarters - this is the Insurance/Banking headquarters.

But for other businesses like factories I think if the factory makes a profit the factory profit goes to the city. This might potentially lead to a situation where you could engage in Base erosion and profit shifting, such as making losses in retail within the high tax cities but having the factories in a low tax city making all the profit. But I haven't tried it as I am not sure if that is how it works or how effective it might be.

I also don't know how this effects other ways of making profit such as stocks/bonds/dividends which are not tied to a specific firm. I tried once having my parent company (instead of Insurance) buy up a huge amount of the global stock market - but strangely the city where my headquarters was located didn't experience any major tax boom (but my insurance city was being deprived of revenue).

In fact it looks like the dividends are not taxed at all:

Would be good to see if anyone has any additional information on this.

Hehehe... lucky you, I have way too much time on my hands

I cheated in a bunch of money and set up a game with 2 cities. One I named Tax haven, and I set the corporate tax to 0. In there, I set up a simple supply chain to make bread. It shipped the bread to the starter city, Mashaka, with a corp. tax of 18%.

I then ran 3 trials on the same save file for exactly 1 year, and the only thing I changed was the price that the factory sold the bread to the retail store.

Here is the balance sheet initially

Here is the control after 1 year where I didn't touch the factory price at all.

Here is the balance sheet after charging the max price of 6.27$

and here is the balance sheet after selling the bread internally for 1 cent.

It's pretty easy to see that while net profit varied by around 10K from experiment to experiment, shifting your reported profits has a massive effect on tax deductions, especially when you overcharge yourself for bread had much larger variations, in around the ballpark of 200K. in other words, this probably isn't informed by random chance.

It seems to be the opposite of what we predicted though. Moving profits into the industries in the tax haven racked up much deductions. There is def something funky going on.

-

Max

- Level 2 user

- Posts: 24

- Joined: Mon Nov 20, 2023 10:47 pm

Re: Tax Haven

Actually, I bet you can exploit this pretty easily. The base price of a bracelet is 3601$, but has a shipping cost multiplier of 1. I bet you can rack up serious tax credits if you have 2 large warehouses shipping them between to two adjacent cities with max corp tax and min corp tax. You'd need to found 2 cities, but in the late game when you have billions it might be a genuinely useful strategy. Would probably be illegal to do IRL thoMax wrote: ↑Fri Dec 01, 2023 6:38 amStylesjl wrote: ↑Thu Nov 23, 2023 6:09 am I am not entirely sure how it normally works. But I think it is based on the firms individual profit/loss. For example if you setup Banking/Insurance the taxes go to the city it is headquartered in, which can lead to a situation where if these firms become very profitable you could end up having a city with HUGE amounts of tax revenue coming in (and hence that city can lower taxes/lavishly spend). I figured this out because that's what happened, the cities I had those firms headquartered in pulled in huge amounts of taxes. But this is not the company headquarters - this is the Insurance/Banking headquarters.

But for other businesses like factories I think if the factory makes a profit the factory profit goes to the city. This might potentially lead to a situation where you could engage in Base erosion and profit shifting, such as making losses in retail within the high tax cities but having the factories in a low tax city making all the profit. But I haven't tried it as I am not sure if that is how it works or how effective it might be.

I also don't know how this effects other ways of making profit such as stocks/bonds/dividends which are not tied to a specific firm. I tried once having my parent company (instead of Insurance) buy up a huge amount of the global stock market - but strangely the city where my headquarters was located didn't experience any major tax boom (but my insurance city was being deprived of revenue).

In fact it looks like the dividends are not taxed at all:

Would be good to see if anyone has any additional information on this.

Hehehe... lucky you, I have way too much time on my handstime to do some science!

I cheated in a bunch of money and set up a game with 2 cities. One I named Tax haven, and I set the corporate tax to 0. In there, I set up a simple supply chain to make bread. It shipped the bread to the starter city, Mashaka, with a corp. tax of 18%.

I then ran 3 trials on the same save file for exactly 1 year, and the only thing I changed was the price that the factory sold the bread to the retail store.

Here is the balance sheet initially

Here is the control after 1 year where I didn't touch the factory price at all.

Here is the balance sheet after charging the max price of 6.27$

and here is the balance sheet after selling the bread internally for 1 cent.

It's pretty easy to see that while net profit varied by around 10K from experiment to experiment, shifting your reported profits has a massive effect on tax deductions, especially when you overcharge yourself for bread had much larger variations, in around the ballpark of 200K. in other words, this probably isn't informed by random chance.

It seems to be the opposite of what we predicted though. Moving profits into the industries in the tax haven racked up much deductions. There is def something funky going on.