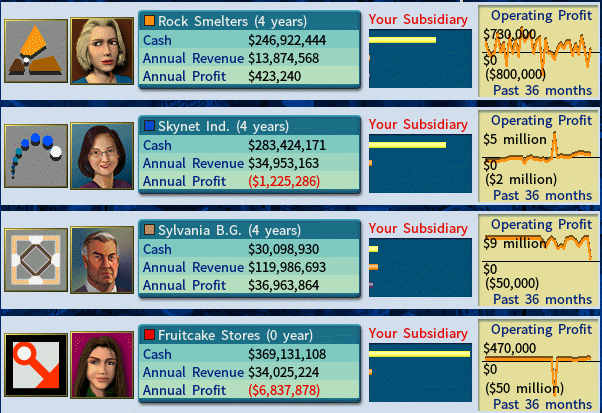

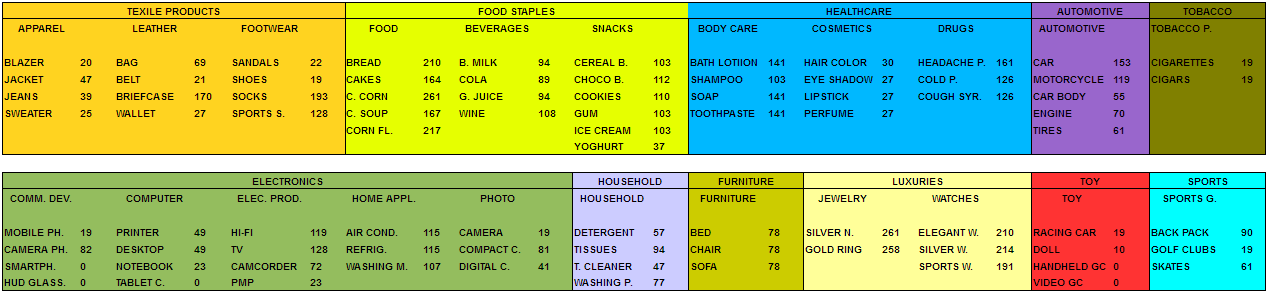

SUBSIDIARIES.

Here´s a summary of all our subsidiaries. It is presented so you can see at a glance those that did set sail and those still berthed.

In our opinion, the ones showing an (estimated?) annual loss are the ones that should be reviewed with care, and so we did, giving you just a few remarks now.

- Subsidiaries1-feb2012.png (240.82 KiB) Viewed 12488 times

- Subsidiaries2-feb2012.png (104.46 KiB) Viewed 12488 times

Putting aside our most recent ventures from that category:

A) We see Falcon Industries and Buzzard Automotive both steadily climbing their way out of the mire.

The first (Falcon) has a promising outlook as they have access to the new electronic products (camcorder&portable player). Also, part of their competition (Magnet Corp, one of three with expertise in the field) will be absorbed soon by Tomahawk, as they are on the verge of bankrupcy (so we claim).

The second (Buzzard) has the usual problems of both having a very limited variety of goods to sell (car&motorcycle) and on top of that their own specialized retail store.

We are helping them by means of R&D so they can establish a proper supply chain of semi-products and see if we can help them boost the final quality of their automotive brand.

About their competition (Anlin Corp), we reviewed them in an earlier post, but just to mention it now they are a big corporation with a horrible brand (corporate brand with both autos and sports goods, deep negative) and many natural resource-semi-farm firms.

Losing money and steadily falling into a debt hole, it might take them many years to go under, unless investors (bank&private) lose faith first, for the best course for Anlin would be to be taken apart, sold piecemeal and their name erased from all memory.

B) Skynet industries: are just starting to retail their own products (camera phones), as we recently appointed a new and more active CEO. Their field is telecom and there is one competitor: an investment firm turned diversified (Ideas Hotbed Corp).

As both the smartphone and Hud glasses will probably be invented by our subsidiary, or their parent, it´s just a matter of time to see them making big money.

In any case, their camera phones have at this moment lvl 100 quality vs the competition´s 50. On the other hand they have a much less developed distribution infrastructure (6 retail stores vs 18!)

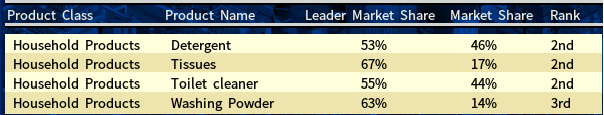

C) Tidy-Mart Inc: are facing tough competition from one Shining Star Corp (household products).

We´re happy enough offering them liquidity as long as they use it to expand, produce and hire folks, but we´d like to see both Shining Star´s investors and lenders pick up the bill, and not us. Let´s see how they are faring vs them.

- Household dominance-Tidy-Mart-feb2012.png (30.23 KiB) Viewed 12488 times

We can see they have not jumped fully into two of their possible consumer products. We visited their stores and saw they JUST started selling washing powder and tissues in two of the four cities. That explains the low market share.

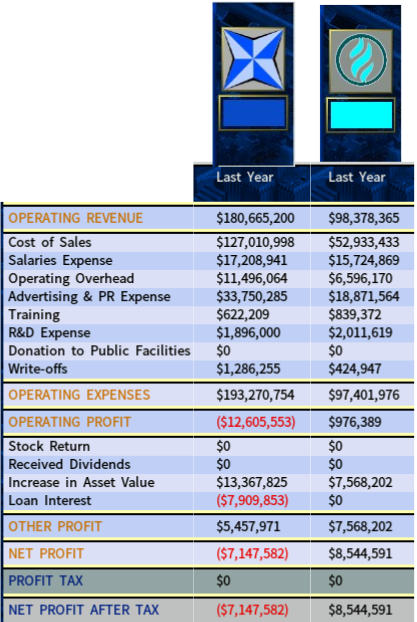

- Household Corporations IS-feb2012.png (190.88 KiB) Viewed 12488 times

Looking at 2011´s Income Statement we can see that the costs of sales are 70% vs our 54% of revenues (sales efficiency). That, together with a much higher cost to keep their brand (twice as expensive) gives us a nice competitive edge. Despite the above the margins are thin and we barely break even.

On top of that Shining Star has to pay 8mm/year in interests.

As there is room to grab some more market share we assume that in the future we´ll do somehow better and they will spiral down, as long as our "efficiency" edge remains.

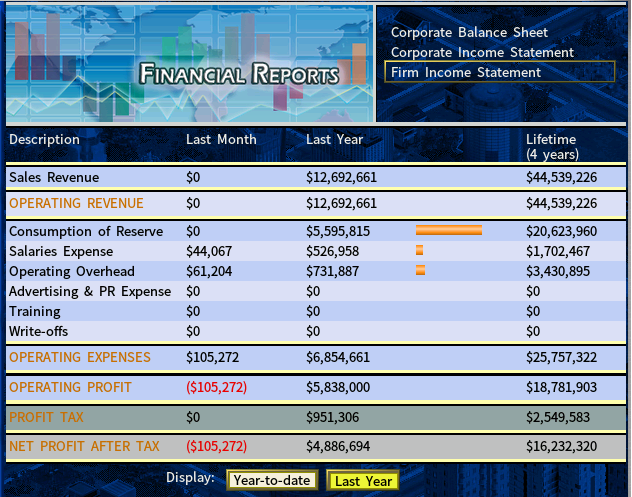

D) Finally, our resource subsidiary Rock Smelters: The gold mine they were operating just stopped producing, so we went to the books to asses its profitability.

Easy done? well, we looked into the firm statements and saw a 16mm net profit. BUT, we cannot see how much we paid for it! That´s where a cash flow statement could come in handy.

- Gold mine 1-Lambs Grove-feb2012.png (157.49 KiB) Viewed 12488 times

As we have been wise enough to prepare for such an occurrence, we loaded the game previous to our purchase to see the cost of the mine "to be".

- Gold mine to be.png (610.13 KiB) Viewed 12488 times

So 21 million$, plus the building.

Obviously, we haven´t considered the benefits derived that our gold mine provided our other subsidiary making gold rings, as the market for gold was back then monopolized by Global Link...

As a side note, mention that the possibilities to expand in natural resource production are currently very limited, as there are no cheap locations available and most other corporations have sunk their cash reserves into setting up extraction facilities. We will try to be alert to any news regarding the finding of new deposits of any kind of resource to see if they don´t come with a land cost premium.

TECHNOLOGY:

Finally, we prepared a list of our completed research. Despite being very simple, it gives us a nice snapshot.

I believe it would be nice to add current research (subsidiaries included), leadership, and possible purchases too, but that for another time.

- Product technology-feb 2012.png (33.1 KiB) Viewed 12488 times

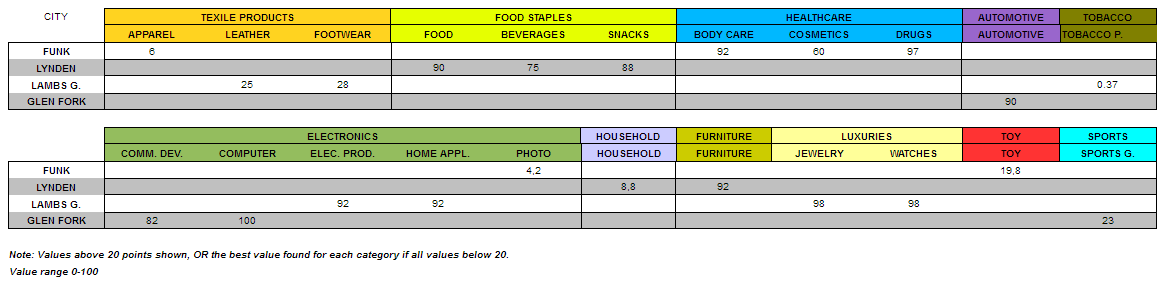

If you wonder how we achieved such advanced technology for segments where we have no expertise (like food staples), the answer is we hire researchers from the universities. That said, we should present another snapshot of city competitiveness (linked to university research), so here it is.

These two will help us assess our position, current and future.

- City competitiveness-feb 2012.png (17.96 KiB) Viewed 12488 times

REAL ESTATE:

We built since 2010: 25 new apartment buildings and 11 office buildings. The supply is still higher than the demand for both, and we are keeping it there, between the 0-10 range.

The moment we see money rates coming down we´ll speed up the construction and keep the supply above the 10 range.

Once we reach 2020 we´d like to offer a chart correlating the RE supply with the GDP and see if it matches.