Rule 1 - Never have more than 1 profitable company

If you have 3-4 healthy companies/subsidiaries that are profitable you are doing it wrong! Each of these companies is paying taxes, you are not taking advantage of accumulated losses.

Rule 2 - You need to be accumulating losses at as many companies as you can, the easiest way to do this in Capitalism Lab is through Advertising (there are several ways it is done IRL but it is not a function of the game *thank god*)

I personally like to have legacy media in each city, but this is even easier with an internet company. Basically you crank your advertising up to the max to your 'target' company which will be your one profitable firm, All your other firms doing this will take a loss, these losses are accumulated as a credit against future profits. After some time you can simply reverse the process by having company that has no accumulated losses start to advertise at ridiculous levels with the company that now has the accumulated losses.

You might be thinking to yourself, isn't this just moving money around? Are you actually making anything? The answer comes from the accumulated losses, if you have had the companies not doing this then neither would be accumulating losses and every $ of loss counts as a credit against future profits.

There is a few other ways to do this but as I said advertising is the easiest. This is also very easy to do between companies with 100% ownership as you can "reload" the company that is getting hit with these "losses" over and over either through a capital injection or special dividend. But you can also do it with companies you want to take over it may be a bit slower since you need to reload the company with the cash lost with either issuing new shares or a special dividend that is not 100% returned to the parent.

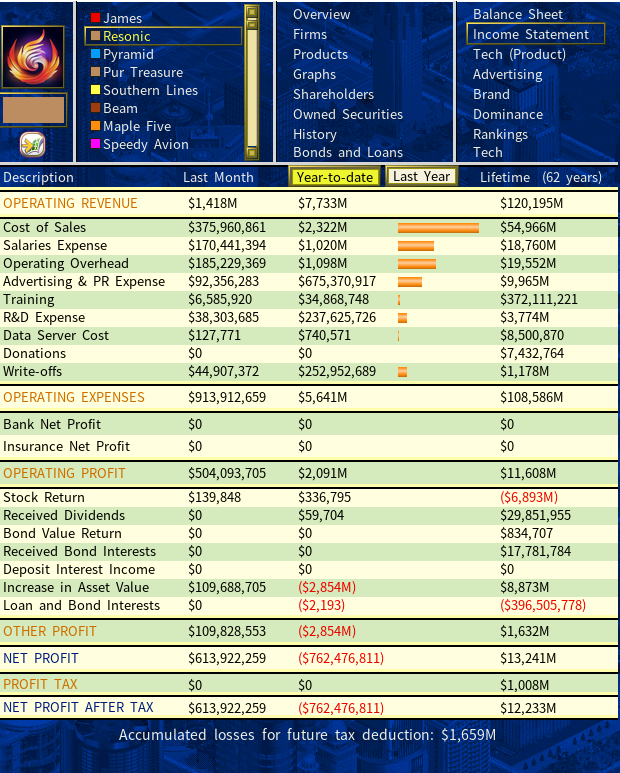

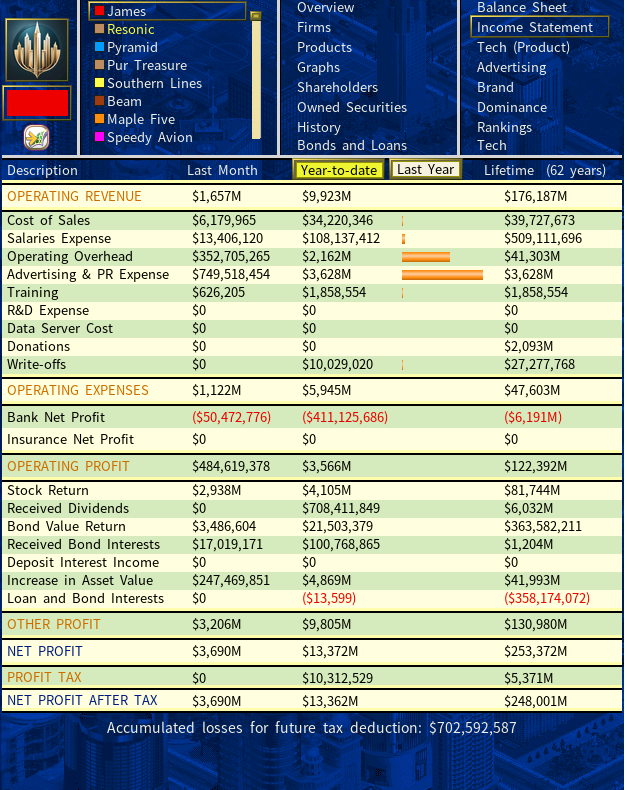

As you can see below, both my and my subsidiary have accumulated losses so we will never pay tax, even though we are both profitable companies, we just moved the money in a way to accumulate losses.

The way this was done IRL was with 'consultations'. I looked at our finance and we were being charged 100,000's of dollars weekly for consultations that never happened... We had people from the parent company show up (they flew in) and take us out to lunch and then fly home every month or so.. I didn't mind the nice dinner, but I didn't realize it was a way for them to make our company lose money purposefully.